Small and medium-sized enterprises (SMEs) play a vital role in Singapore’s economy, forming 99 per cent of total enterprises, contributing 43 per cent of value-added and offering employment to 70 per cent of the workforce. For Singapore to achieve economic expansion of 2 to 3 per cent per year over the next decade, it is imperative to support enterprises, and in particular, SMEs, to boost productivity through digital technologies adoption. In this aspect, the financial sector, and in particular the impact of fintech lending, could lend support to the development of SMEs.

These insights were shared by the Singapore Management University’s (SMU’s) Associate Professor of Economics (Practice), Tan Swee Liang, at “Economics in the News”, a virtual one-day event held on 27 May 2022 and organised by the Economic Society of Singapore, in collaboration with ESSEC Business School Asia-Pacific. Prof Tan addressed students, academics, economics professionals and members of the public during her hour-long presentation, titled “Can fintech help SMEs’ drive Singapore’s productivity?”

“Bank lending aside, an alternative form of financing has emerged in the last decade - fintech lending. Fintech (shortened from financial technology) is about combining the latest technological developments such as artificial intelligence (AI), distributed computing, cryptography, mobile access internet with financial services and applications in areas of payment, savings, borrowing, managing risks, and seeking financial advice,” commented Prof Tan.

“Different types of fintech credit models have emerged,” explained Prof Tan. “One example is the peer-to-peer P2P lending platform (or, crowdfunding) which provides an online market for lenders (creditors) to trade directly with borrowers. What makes crowdfunding attractive for the SMEs compared to bank loans is that the loans are usually not collateralised, of a smaller quantum and of a shorter loan duration, with faster approval time. Of interest in the last two years during the pandemic is the platform's capability to mitigate asymmetric information problems of adverse selection and moral hazard using AI, big-data, machine learning, and digitalisation to screen and monitor borrowers when there is economic downturn.”

In Singapore pre-pandemic, there were 19 crowdfunding platforms as of 2018. Loans amounting to US$191 million was raised via crowdfunding, amounting to 0.29% of banks’ lending to SMEs. In other countries, crowdfunding shares to bank credit are also small. Prof Tan elaborated that fintech lending in Singapore and Asia is a relatively new development and the Monetary Authority of Singapore (MAS) seeks to balance improving access to capital for businesses and mitigating the financial stability risks arising from fintech activities. MAS also adopts a proportionate approach to regulating crowdfunding, by applying risk-appropriate regulations to the specific activities that are conducted, be it lending to corporations or individuals.

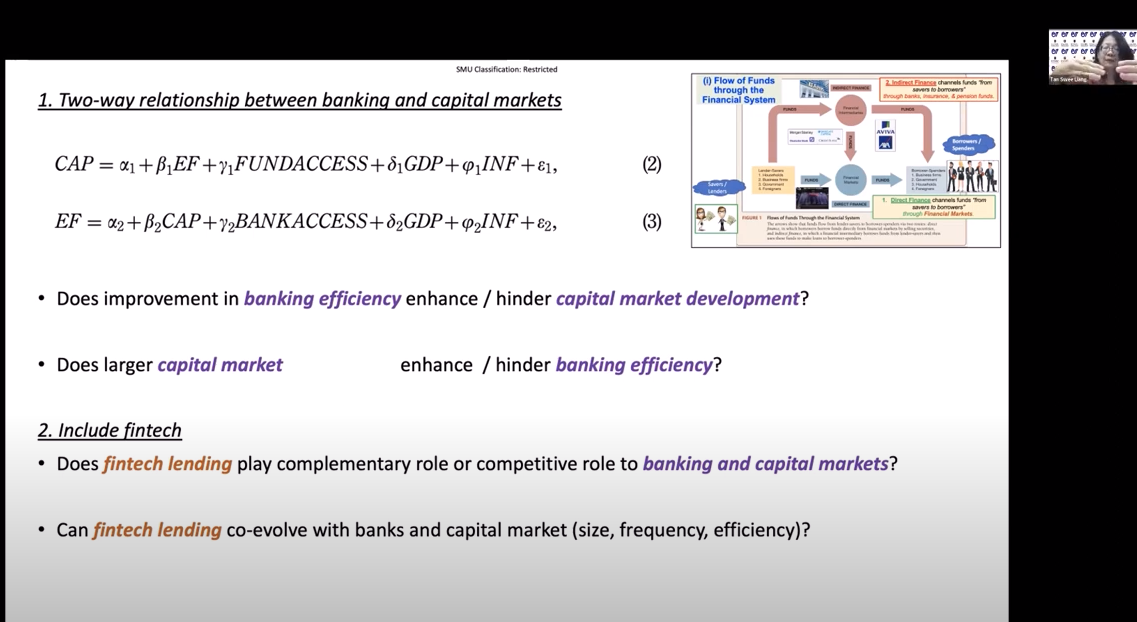

The emergence of new digital technologies has enabled non-bank entities to provide financial services to parts of society that are un(der)-served. These entities (fintech) hold the potential to address barriers that SMEs face in accessing credit. Whether fintech lending plays a complementary or competitive role, or co-evolve with banks, in terms of size, frequency, efficiency, can determine the effectiveness of funding for SMEs.

Prof Tan opined that role identification is especially important for a maturing economy such as Singapore. A complementary role only serves to address financing gaps that might be missed by the traditional lenders, while competition may lead to unnecessary risk-taking behaviours of banks and fintech lenders, leading to financial instability. She commented that co-evolving relationships with positive feedback loops can lead to size, frequency, and efficiency gains between bank and fintech lending, which in turn will help SMEs expand. Prof Tan concludes policies to facilitate efficient funding of scarce capital by promoting traditional and innovative channels to co-evolve together, will become critical for Singapore to achieve economic expansion of 2 to 3 per cent per year over the next decade.

Prof Tan was participating at the event in line with SMU’s strategic priority area of “Growth in Asia”, where the University sought to offer a deep understanding of Asia’s economy, polity and society.