SINGAPORE, 13 September 2021 (Monday) - Researchers at the Citi Foundation - SMU Financial Literacy (FinLIT) Programme for Young Adults hosted in the Sim Kee Boon Institute For Financial Economics at the Singapore Management University conducted the inaugural Financial Inclusion, Wellness and Resilience (FInWR) survey between March to April 2021. This national benchmarking survey included 1,068 respondents who are young adults aged between 18-30. It aims to understand the factors influencing financial wellness - including financial literacy – amongst young adults in Singapore, and to ascertain their capacity (i.e. resilience) to withstand financial challenges, in light of potential disruptions caused by the ongoing pandemic, the changing financial landscape and the evolving job market.

Assistant Professor Aurobindo Ghosh, Citi Foundation- SMU FinLIT Programme Director and Principal Investigator (Research), head of the FInWR research project shared key findings of the survey at the 8th Citi-SMU Financial Literacy Symposium held on 10-11 September.

Key Findings:

(a) Respondents performed relatively well in functional areas of Saving, Borrowing, Budgeting, Digital Literacy and Consuming. They performed less well in other areas such as Earning, Investing, Fintech, Insurance and Comprehending Risk, scoring less than the average financial wellness score of 63.7%, with the lowest being in Earning at sub 50% level.

(b) Some notable observations are as follows:

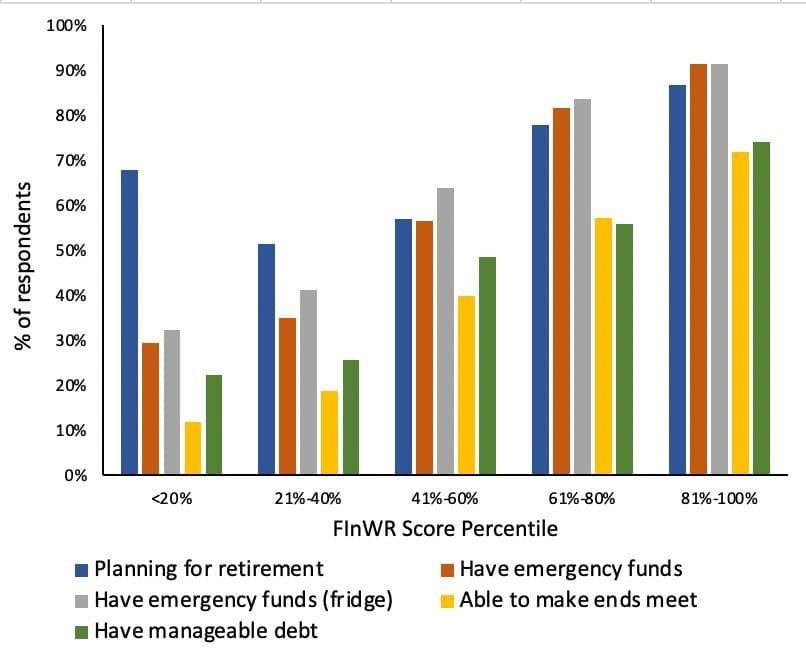

- 96.9% have started planning for retirement.

- 33% of respondents are not confident in managing debt and 19% found it difficult to make ends meet.

- 98% would find it easy to arrange for emergency purchases while 22% would find it difficult to arrange for emergency cash.

- These results are generally consistent with similar academic studies amongst the US population by Lusardi, Hasler and Yakobski, 2020. However, the main difference is that respondents of this survey expressed greater confidence in planning for retirement, possibly due to the availability of Central Provident Fund (CPF), and in their ability to make ends meet.

(c) Higher FinWR scores were consistent with higher financial resilience in the survey responses as described in Figure 1, except for planning for retirement. This is again probably due to theavailability of CPF and awareness raised about it. This means lower percentiles of FinWR scores equate less financial resilience in terms of debt management, access to emergency funds for cash or purchase, and being able to make ends meet.

(d) The study also found that respondents with a higher FinWR score were less likely to fall for a financial scam.

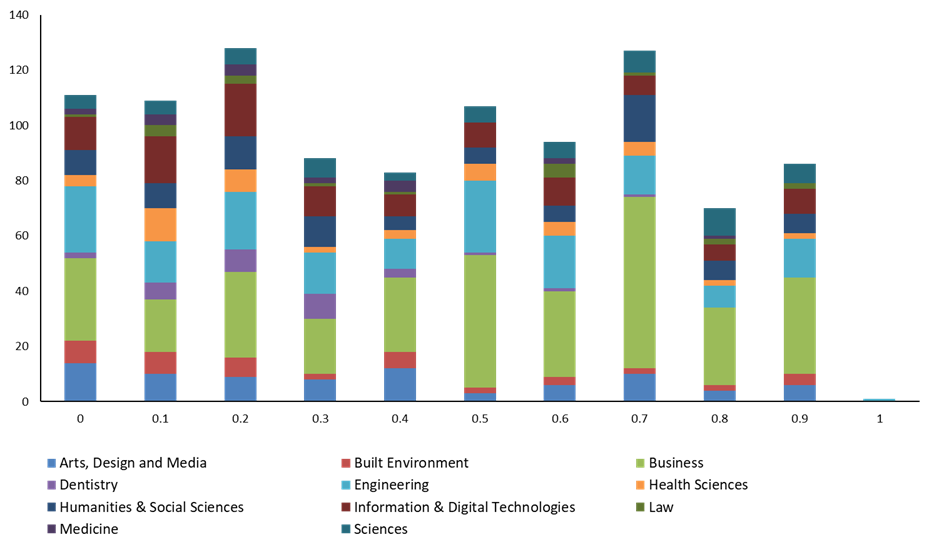

(e) There is a difference between FinWR scores across different disciplines of study. Respondents from disciplines such as Business, Information and Digital Technology, have a higher likelihood of being on higher percentiles of FInWR scores compared to certain disciplines like Art, Design and Media, Dentistry (Figure 2).

(f) Young adults trained in Business tended to place higher in financial wellness and resilience than those trained in non-business subjects (medicine, dentistry, engineering, arts, media and design). Non-STEM students also tended to have higher FInWR score than STEM students.

(g) When comparing the FInWR scores by the demographic profile of respondents, the study discovered that young adults who are working do not perform as well as those who are not working in most components, except Fintech.

Applauding the Program’s efforts to increase financial literacy awareness in Singapore, SMU President Professor Lily Kong agreed that “the survey findings are an important reference for various stakeholders to formulate intervention measures for different young adult groups to level up their financial literacy, and beyond that, strengthen their financial resilience.”

Assistant Professor Aurobindo Ghosh, Program Director and Principal Investigator (Research), head of the FInWR research project added that, “According to a University of Maryland Guide to Living Well, ‘Financial Wellness includes our relationship with money, skills to manage resources to live within our means, making informed financial decisions and investments, setting realistic goals, and learning to prepare for short-term and long-term needs or emergencies. Part of this dimension includes an awareness that everyone’s financial values, needs, and circumstances are unique.’”

Head of ASEAN and Citi Country Officer for Singapore, Amol Gupte, commented on the effectiveness of the Citi Foundation-SMU FinLIT programme, “I am delighted that as we enter the tenth year of Citi’s partnership with SMU, our joint project remains relevant in its mission to strengthen financial literacy amongst young adults. The results give a positive indication of its effectiveness, particularly the finding that more than 73% of participants demonstrated an improved financial literacy score three to six months after participating in the Programme.”

“Financial wellness and financial resilience are key factors of personal and professional development goals that are catalysed by financial inclusion. Individuals with working financial knowledge and thus sufficient financial wellness and resilience at an early stage can make more informed economic decisions and judgements vis-à-vis the aggregate population. In sum, in this ongoing research, we want to produce a comprehensive quantitative measure of participants’ financial wellness and resilience score to benchmark future improvements and study the relationship and dynamics among these components,” Prof Ghosh observed.

About the Inaugural Financial Inclusion, Wellness and Resilience (FInWR) Survey

A total of 1,068 young adults participated in the survey under the auspices of SMU Institutional Review Board for academic research on human subjects. Half the respondents were aged between 18 to 24 years old, who had participated in the first ever Virtual MyMoney@Campus co-organized by MoneySense (the national financial education programme in Singapore), the Association of Banks in Singapore (ABS) and Citi Foundation-SMU FinLIT programme. The other half were young working adults aged between 25 to 30 years.

Besides demographic and socio-economic questions, the survey respondents answered a series of questions categorised according to topical components of comprehending risk, saving, borrowing, digital literacy, fintech, budgeting, sustainability, insuring, investing, consuming, earning and go-to-info sources. The survey produced a comprehensive quantitative measure of participants’ financial wellness and resilience score (0 to 330) to benchmark future waves of the FInWR and other financial literacy surveys.

About Citi Foundation-SMU Financial Literacy Programme for Young Adults

Launched in April 2012 by Citi Singapore and Singapore Management University with the support of the Citi Foundation, the Citi Foundation-SMU Financial Literacy Programme for Young Adults seeks to equip young adults between the ages of 15 and 30 with essential personal finance knowledge and skills applicable to their life stage to give them a firm foundation in managing their money and a financial head-start early in their lives.

Since the launch of the Programme, over 70,000 young adults have benefited from being engaged on a wide range of topics including basic money and credit management, financial and retirement planning, home and car ownership as well as principles of investment. Through its unique peer-to-peer training model, over 1,100 student trainers have been certified through the Programme.

We have partnered various stakeholders, including government ministries and agencies such as MOM, MAS, MOE, NYC, CPF Board and HDB to improve financial literacy of the young adults in Singapore through various initiatives such as My Money @ Campus Carnivals and Seminars; Financial Inclusion Hackathon; Financial Inclusion, Wellness and Resilience Survey; Train-the-Trainers Programme and Financial Health Check.

For more information, visit our website: https://skbi.smu.edu.sg/finlit, Facebook page: https://www.facebook.com/cs.flya and Instagram account: @cfs_finlit.