These are the research findings of the 40th round of quarterly release for the DBS-SKBI Singapore Index of Inflation Expectations (SInDEx) Survey at the Sim Kee Boon Institute for Financial Economics (SKBI), Singapore Management University (SMU).

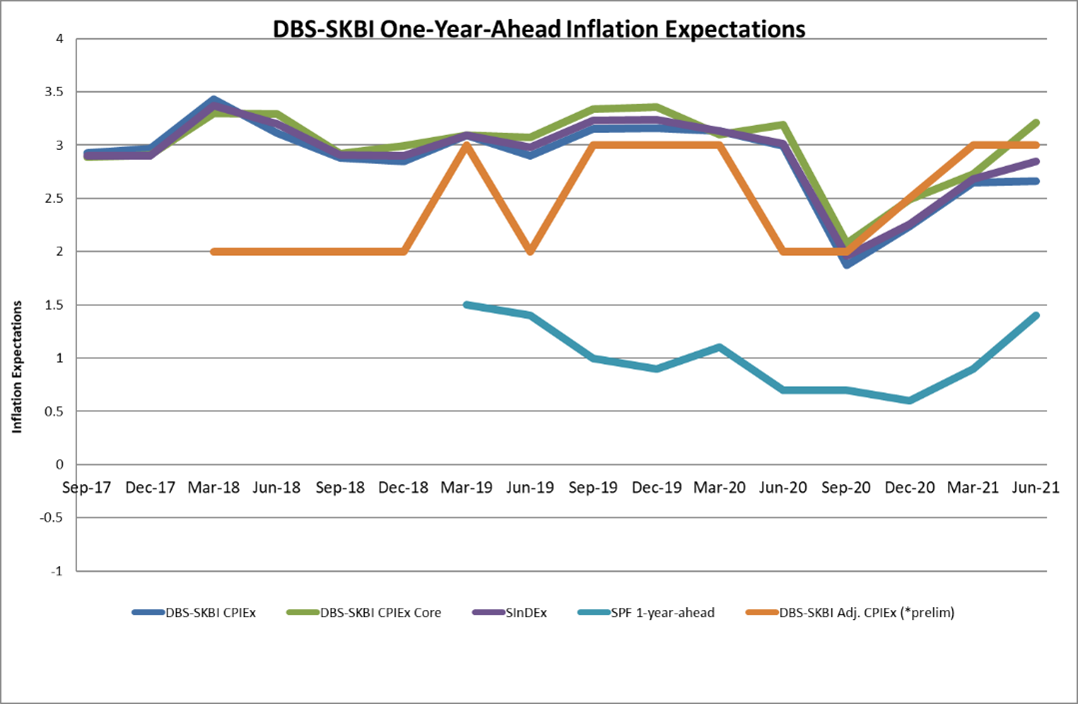

- One-year-Ahead headline inflation expectations remained unchanged, staying at 2.7% in June 2021 from March 2021. Headline inflation expectation, which has been on an upward trend since September 2020, remained flat, with a lower reading than the historical (2012-2020) second quarter average of 3.3%.

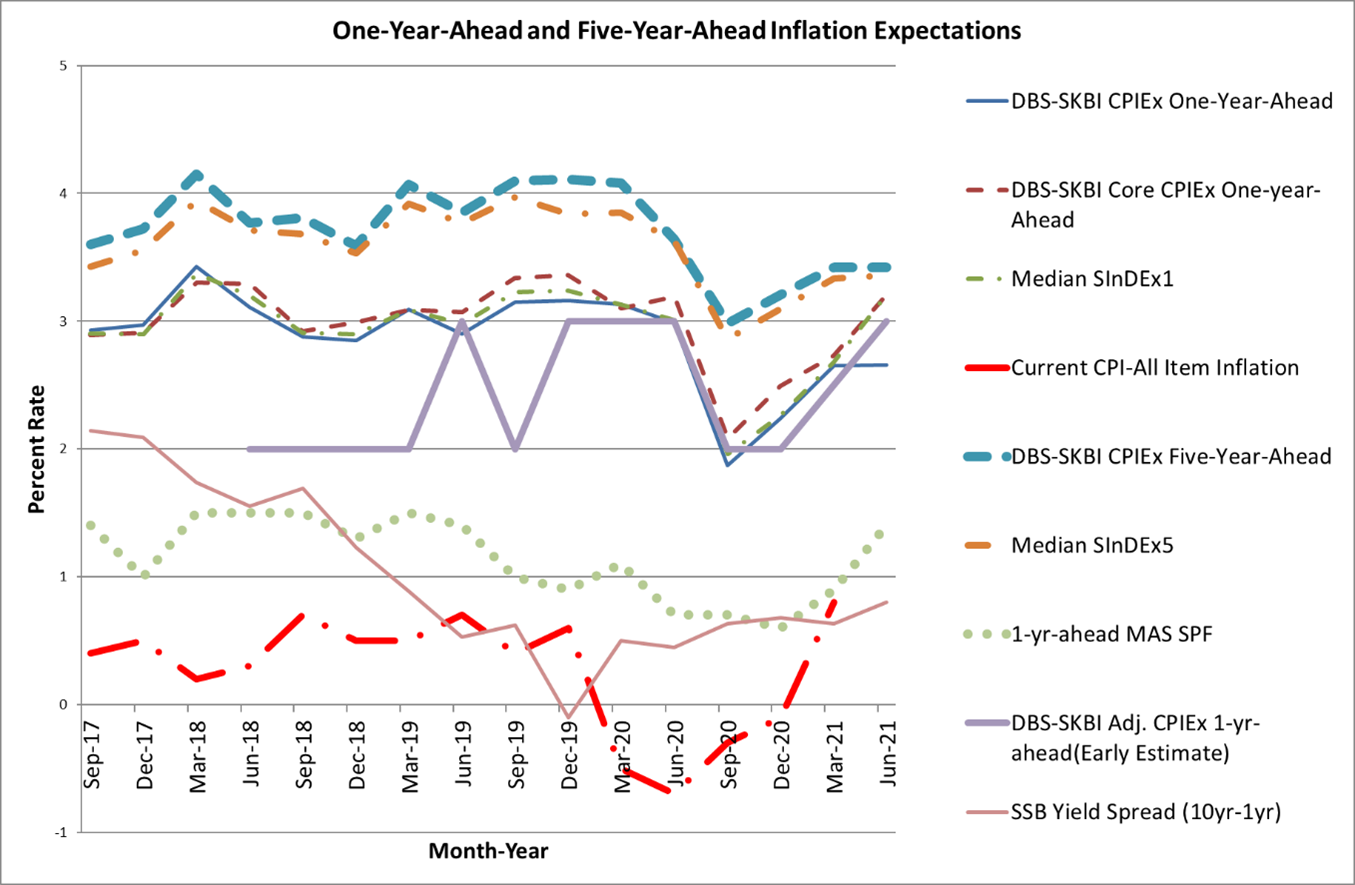

- As expected, MAS kept the monetary policy unchanged for their April review. As a comparison benchmark, the MAS Survey of Professional Forecasters (MAS SPF) data released in June 2021 showed that the median forecasts of CPI All-Items inflation for 2021 was 1.4%, up from 0.9% in the March 2021 survey. The latest release from Department of Statistics showed that average CPI-All Items in Jan–May this year was 1.3% higher compared to the reading in the same period last year.

- The overall CPIEx Inflation Expectations, after adjusting for potential behavioural biases and re-combining across components, edged down to 3% in June 2021 from 3.1% in March 2021. Inflation expectations for majority of the components like food, housing & utilities, transport, healthcare, education and communication have remained unchanged, while that for recreation & culture, clothing & footwear, and miscellaneous goods and services like personal care and personal effects have come down. In comparison, inflation expectations for household durables & services have gone up slightly. We also observed that the free response behaviorally adjusted overall inflation expectations remained unchanged at 3.0% in June 2021 compared to the March 2021 survey. There seems to be a convergence of the component-wise measures of inflation expectations and the overall aggregated measures. In general, inflation expectations seem anchored.

- In the June 2021 wave, continuing the analysis we embarked on since September 2020, an in-depth survey on the potential impact of Covid-19 on inflation expectations of different components of CPI was conducted. Unlike the March 2021 wave, we found that the inflation expectations for most components including food, transport, housing & utilities, healthcare, education, communications, household durables & services, and miscellaneous goods and services, as well as overall One-year-Ahead and Five- year-Ahead inflation expectations were expected to have a limited positive impact from Covid-19. However, inflation expectations for recreation & culture and clothes & footwear did not see an uptick due to Covid-19, with retail and entertainment venues still under heightened alert phase.

- Following the academic work by Alberto Cavallo of Harvard Business School (2020) and the UK Office of National Statistics (ONS), respondents were asked if there were any substantive changes to their consumption basket. However, unlike in March 2021 when households’ consumption patterns appeared to continue at pre-Covid norms as consumer spending picked up and economic activities resumed, the June 2021 survey polled some changes in the consumption basket. In June 2021, results suggest there is some limited increase in household spending on housing & utilities, which seem to offset lower transportation expenses. Given the prevalence of work-from-home arrangement during the heightened alert phase, many employees incur lower transportation cost but higher utility expenses.

- Excluding accommodation and private road transportation related costs, the One-year-Ahead CPIEx core inflation expectations rose to 3.2% in June 2021 (from 2.7% in March 2021). This increase possibly reflected renewed economic activities, as well as the recovery of global inflation alongside an upswing in world commodity prices such as oil.

- For a subgroup of the population who owns their accommodation and uses public transport, the One-year-Ahead CPIEx core inflation expectations also increased to 2.7% in June 2021 from 2.6% in March 2021. Not being exposed to expenses related to private road transportation or housing rentals, this subgroup’s expectations of core inflation closely resemble the Singapore Core Inflation Expectations. The increase in One-year-Ahead Core inflation expectations rate might not be that dramatic but still edged up in June 2021.

- The One-year-Ahead composite index SInDEx1 that puts less weight on more volatile components like accommodation, private road transport, food and energy related expenses polled at 2.9% in June 2021 compared to 2.7% in March 2021. This remained below the second quarter average of 3.3% since the survey’s inception in 2012 till 2020.

- In June 2021, around 70% of the survey respondents reported their belief that Covid-19’s impact on inflation would be significant compared to 67% in March 2021. The share of survey respondents who feel that Covid-19 will have long-term impact on inflation increased to around 73%, from about 67% in March 2021. Both results indicate the euphoria of the vaccine rollout might have been dampened by the tighter public health measures under Phase 2 and Phase 3 (Heightened Alert) as well as the emergence of highly transmissible and potentially virulent variants. This increased the possibility of an endemic Covid-19.

- In addition, around 12.5% of the Singaporeans polled expect a more than 5% reduction in salary in the next 12 months, this is a lower proportion compared to 14.1% in March 2021. The median salary increment expectations stayed between -1% and 1%.

- As a measure of the tradeoff between prioritising economic growth compared to the cost to life, the so-called livelihood over life debate, the ratio was 3.1 in June 2021, higher than 2.3 in March 2021. This means for every person who prioritised life over livelihood, there are three who prioritised livelihood over life. This is a clear indication that there is a demand for a return to normalcy from the respondents, although policymakers have to take into account potentially vulnerable groups who might not have been vaccinated yet.

Figure 1: One-year-Ahead-inflation expectations: The chart shows the quarterly DBS-SKBI CPIEx (CPI-All Item) and DBS-SKBI CPIEx Core (Excluding accommodation and private road transportation components) One-Year-Ahead Inflation Expectations polled in the quarterly online Singapore Index of Inflation Expectations (SInDex) Survey conducted June 17-25, 2021.

DBS Chief Economist and Managing Director of Group Research, Dr. Taimur Baig commented, “As vaccination progresses and gradual economic re-opening comes into focus, consumer confidence is likely to improve, which may also be associated with a rise in inflation expectations. But having recovered earlier this year, price expectations have stabilised in Singapore. This perhaps reflects lingering uncertainty about the timing and extent of reopening this year, casting a shadow on the outlook for further rise in demand, wages, and prices.”

SMU Assistant Professor of Finance and founding Principal Investigator of the DBS-SKBI SInDEx Project, Aurobindo Ghosh observed, “One of our objectives in this survey is to identify whether there are imminent challenges to a dashboard of component-wise inflation expectations, and not just an aggregate level. While the SInDEx survey suggests overall inflation expectations seem to flatten with prospects of Federal Reserve tapering of accommodative policy in 2023, but possible upswing in global commodity market or even a nascent commodity super-cycle seems to be pushing up the energy and commodity components and consequently medium term Singapore Core Inflation Expectations.”

“There is also some divergence in perception. Some survey respondents opined the pandemic would have a slight upward pressure on certain major components like food, housing & utilities, transport, healthcare, education etc., while others disagreed. Following Alberto Cavallo (2020), we also find that household consumption have shifted from transportation to housing & utilities, particularly because work-from-home continues to be the default option.”

For the longer horizon, the Five-year-Ahead CPIEx inflation expectations in the June 2021 survey remained unchanged at 3.4% from March 2021. The current polled number is significantly lower than the second quarter average of 4.1% since the survey’s inception in 2012 till 2020.

The Five-year-Ahead CPIEx core inflation expectations (excluding accommodation and private road transportation related costs) also remained unchanged at 3.3% in June 2021 compared to March 2021. Overall, the composite Five-year-Ahead SInDEx5 also increased to 3.4% in June 2021 from 3.3% in March 2021. In comparison, the second quarter average value of the composite Five-year-Ahead SInDEx5 was 4% since the survey’s inception in 2012 till 2019.

“In the Global Economic Prospects report released in June 2021, World Bank Group President David Malpass warned that protectionist policy might be counterproductive, and observed that ”The pandemic not only reversed gains in global poverty reduction …but also deepened the challenges of food insecurity and rising food prices for many millions of people.” Long term inflation expectations, both the raw numbers and those adjusted for behavioural biases, seem to be stable and unchanged from the March 2021 survey. This is a strong indicator of some degree of anchoring of inflation expectations. There is also evidence of increasing fatigue due to pandemic related restrictions, as reflected in the life and livelihood debate in June 2021 where three respondents chose to prioritise livelihood over life for every respondent who chose life over livelihood, up from two in the March 2021 survey, ” Professor Ghosh commented.

Figure 2: Five-year-Ahead-Inflation Expectations in Singapore: The chart shows the quarterly DBS-SKBI CPIEx (CPI-All Item), DBS-SKBI CPIEx Core (excluding accommodation and private road transportation components), SInDEx (Composite index with lower weights on volatile components like food, energy, accommodation and private road transportation) One-Year and Five-Year-Ahead Inflation Expectations polled online quarterly for the Singapore Index of Inflation Expectations (SInDex) Survey conducted June 17-25, 2021. The chart shows a preliminary estimate of Behaviourally Adjusted One-year-Ahead overall DBS-SKBI Adjusted CPIEx. As comparison benchmarks, the chart provides the most recent quarterly CPI-All Item Inflation, MAS Survey of Professional Forecasters median One-year-Ahead CPI-All Item inflation forecasts and the yield spread of 10-year and 1-year Singapore Savings Bonds (SSB).

Methodology

DBS-SKBI SInDEx survey yields CPIEx Inflation Expectations (estimating headline inflation expectations) and related indices are products of the online survey of around 500 randomly selected individuals representing a cross section of Singaporean households. The survey is led by Principal Investigator Dr. Aurobindo Ghosh, Assistant Professor of Finance (Education) at Lee Kong Chian School of Business, SMU. The online survey, powered by Agility Research and Strategy, helps researchers understand the behaviour and sentiments of decision makers in Singaporean households. DBS Group Research is a co-sponsor and research partner with the Sim Kee Boon Institute for Financial Economics (SKBI) at SMU.

The quarterly DBS-SKBI SInDEx survey has also yielded two composite indices, SInDEx1 and SInDEx5. SInDEx1 and SInDEx5 measure the One-year inflation expectations and the Five-year inflation expectations, respectively. The sampling was done using a quota sample over gender, age and residency status to ensure representativeness of the sample. Employees in some sectors like journalism and marketing were excluded as that might have an effect on their responses to questions on consumption behaviour and expectations.

The DBS-SKBI SInDEx survey was augmented in June 2018, based on a joint research study conducted by SMU researchers in collaboration with MAS and the Behavioral Insights Team, where respondents were polled on their perceptions of components of the Consumers Price Index (CPI) and adjusted for possible behavioural biases prevalent in online surveys.

Based on the recommendations of the joint study, since March 2019 the research team has polled the One-year-Ahead inflation expectations of all of the major components of CPI-All Items inflation. The component-wise inflation expectations have largely stayed the same except a lowering of Recreation & Culture, Clothing & Footwear and Miscellaneous goods and services, and an uptick in household durables and services. In free response answers, compared to March 2021 survey, respondents in the June 2021 survey polled One-year Ahead and Five-year Ahead headline and core inflation expectations to stay the same.

We introduced a new ratio in the June 2020 survey, on the life versus livelihood debate as an aftermath of the Covid 19 pandemic - the ratio of respondents who feels livelihood should be prioritised over life vis-à-vis those who feel the other way . This ratio increased from 2 in March 2021 to 3 in June 2021, which means for every respondent who prioritised life over livelihood, there were 3 who prioritised livelihood over life, signaling a level of pandemic restriction fatigue.