Singapore Management University (SMU) held its third Mapletree Annual Lecture virtually on 31 March 2021, supported by Mapletree Investments. As part of the Mapletree Real Estate Programme in SMU, the lecture seeks to catalyse the development of impactful and meaningful research insights and serves as a platform for private-public-academic discourse on real estate-related topics.

More than 230 SMU students, academics, industry professionals as well as members of the public attended the event, entitled “The Commercial Real Estate Eco-System”.

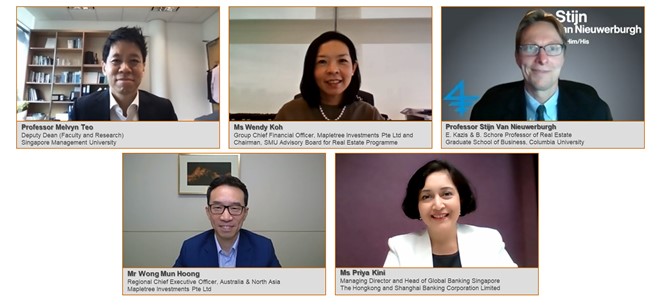

Opening the webinar was Ms Wendy Koh, Chairman of the SMU Advisory Board for Real Estate Programme and Group Chief Financial Officer of Mapletree Investments. Keynote speaker Professor Stijn Van Nieuwerburgh, Earle W. Kazis & Benjamin Schore Professor of Real Estate, Graduate School of Business, Columbia University shared his depth of knowledge, expertise and insights through observations on Commercial Real Estate (CRE) specifically in the United States.

During his 45-minute lecture, Professor Stijn also shared an improved model of CRE valuation that considers investor characteristics on top of property characteristics. Using the new model, he mapped the influence that foreign investors and large private equity funds have had on CRE prices in gateway markets. He also introduced tools that helped to estimate the most important asset characteristics for each investor type.

The lecture was followed by an insightful panel discussion moderated by Professor Melvyn Teo, Deputy Dean (Faculty and Research), SMU Lee Kong Chian School of Business. Besides Professor Stijn, the panel comprised of Mr Wong Mun Hoong, Regional Chief Executive Officer, Australia & North Asia, Mapletree Investments Pte Ltd and Ms Priya Kini, Managing Director and Head of Global Banking Singapore, The Hongkong and Shanghai Banking Corporation Limited.

The panel session covered how work-from-home trends would impact demand for office space, as well as how requirements of sustainability reporting would impact the demand and valuation of CRE.

Mr Wong shared that Covid-19 has accelerated the growth of the long-term demand for logistics and data centres, while retail malls will have to continue to enhance its experiential aspects even when footfall returns post-Covid. He added that although the office sector is most impacted (depending on the region and industry), he does not expect a significant reduction in office footprint in Asia.

In terms of office space, Ms Kini’s view is that most offices will take on a hybrid model as employees with surveillance and compliance roles would still need to work from the office. There would also be a balance of companies giving up office spaces and others taking up more to ensure the provision of a healthy infrastructure for their employees.