A footfall of more than 73,000 students between the ages of 17 and 35 was recorded in My Money @ Campus 2021, where they learned about financial concepts and money management tips during the six-week event. The event was jointly organised by Singapore Management University (through the Sim Kee Boon Institute for Financial Economics and the Citi Foundation-SMU Financial Literacy Programme for Young Adults), as well as MoneySense (the national financial education programme in Singapore) and the Association of Banks in Singapore (ABS).

My Money @ Campus was started by MoneySense in 2015 and aims to equip students in Singapore with financial planning skills before they enter the workforce. In 2018 and 2019, MoneySense collaborated with ABS and SMU to hold mini roadshows on financial literacy at the Polytechnics and the Institute of Technical Education.

The event this year was launched by Ms Gan Siow Huang, Minister of State for Education and Manpower, on 22 February. Held exclusively online, 20 SMU students from the Citi Foundation-SMU Financial Literacy Club conceptualised five online games and two of the five e-learning booths, with guidance from SMU faculty and staff. They worked closely with co-organisers and event vendor to implement and refine the ideas, design marketing strategy and manage the running of the event.

Student participants of the games and e-learning booths not only benefitted from the nuggets of financial wisdom and knowledge, they also accumulated coins to redeem for prizes. Those who topped the leaderboards in the four games (there was no leaderboard for the fifth game) were rewarded with weekly prizes . In addition, by completing at least three games and three e-learning booths, student participants were entitled to participate in the contest, where they could share their learning experience from the virtual carnival. Contest winners would receive exciting prizes including Apple iPad and Nintendo Switch.

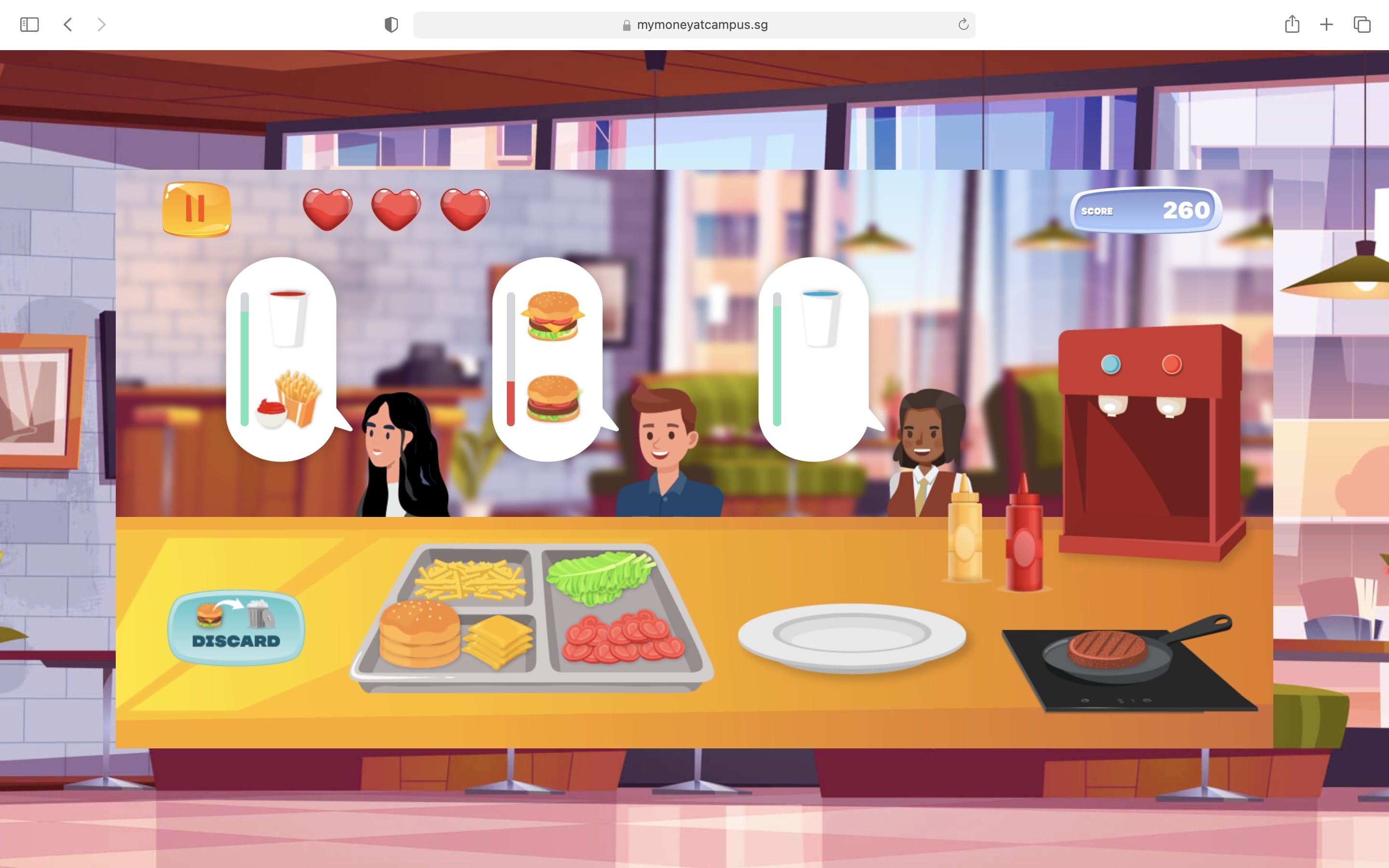

The top two most visited games were ‘Burger Rush’ and ‘Sine Qua Non’. For the former, participants had to serve as many customers as one can by completing the orders for burgers. They have the option to take loans in the form of completing missions, in which they will have to serve a certain number of customers within a short period of time. If they succeeded, they would be rewarded with more points which they can use to repay the loans, else they would lose points and face the snowball effect of compound interest on the loans. The game helped participants to understand the benefits and risks of taking loans, the concept of compound interest, and to only take a loan amount that one can afford to repay.

The game ‘Sine Qua Non’ required participants to identify the needs and wants of each character in the game based on the personal circumstances of each character. The game enabled participants to differentiate between needs and wants, understand that needs and wants may vary from person to person and time to time, and know how to strike a balance between needs and wants.

Of the five e-learning booths, SMU students from the Citi Foundation-SMU Financial Literacy Club conceptualised the ‘Sustainable Finance’ and ‘Financial Technology’ booths. The former helped participants learn more about the topic, its importance, as well as the role of the different stakeholders in promoting sustainable finance; while the latter enabled participants to gain a better understanding on how financial technology can help one better manage their finances, learn more about the different types of financial technology services, and how these services can help one progress towards financial resilience.

SMU Assistant Professor of Finance Aurobindo Ghosh, who is the Programme Director of the Citi Foundation-SMU Financial Literacy Programme for Young Adults, and Faculty Chair for the first ever virtual My Money @ Campus commented, “My Money @ Campus 2021 was conceptualized in 2020, in the middle of a global pandemic. While the whole world was looking at the crisis, the creative organising team and supportive partners worked with Citi Foundation-SMU Financial Literacy Programme for Young Adults and pivoted to the opportunity to increase their outreach and impact. It is therefore not too surprising that this innovative digital event, held for the first time, has achieved significant impact of more than 70,000 footfall.”

SMU student Li Yang, co-chair of the student organising committee, said: “My Money @ Campus was moved online this year due to the pandemic. It was definitely an eye-opening experience organising a virtual event. I felt that this project was rather meaningful because financial literacy is an important skillset every young adult should have. However, many people are either not aware of, or does not pay much attention to, financial literacy. The event aims to educate young adults like myself on simple financial literacy concepts such as investment diversification, necessity vs wants, and avoiding scams through fun and interactive games. On top of this, there were e-learning booths that aim to teach users about CPF, HDB and Financial Technology, to name a few. During difficult times such as this, it is especially important for us to be able to make use and take advantage of these financial literacy skills so that we can better prepare ourselves and manage our expectations as we enter adulthood.”

Michelle Ho, who recently graduated from Nanyang Polytechnic, enthused about the event, “I like ‘Stack the Bucks’ the most! The game taught me a lot about diversification of investments by creating a tall tower of stacked blocks. My Money @ Campus has definitely helped to improve my financial literacy through the use of engaging games and learning booths. The content delivered were relevant and up to date. It was definitely a meaningful and impactful virtual learning experience!”

About Citi Foundation-SMU Financial Literacy Program for Young Adults

Launched in April 2012 by Citi Singapore and Singapore Management University with the support of the Citi Foundation, the Citi Foundation-SMU Financial Literacy Program for Young Adults seeks to equip young adults between the ages of 15 and 30 with essential personal finance knowledge and skills applicable to their life stage to give them a firm foundation in managing their money and a financial head-start early in their lives.

Since the launch of the Program, over 50,000 young adults have benefited from being engaged on a wide range of topics including basic money and credit management, financial and retirement planning, home and car ownership as well as principles of investment. Through its unique peer-to-peer training model, over 900 students trainers have been certified through the Program.

For more information, visit our website at https://skbi.smu.edu.sg/finlit, Facebook page (@cs.flya) and Instagram (@cfs_finlit).