SINGAPORE, 21 January 2021 - These are the research findings of the 38th round of quarterly release for the DBS-SKBI Singapore Index of Inflation Expectations (SInDEx) Survey at the Sim Kee Boon Institute for Financial Economics (SKBI), Singapore Management University (SMU).

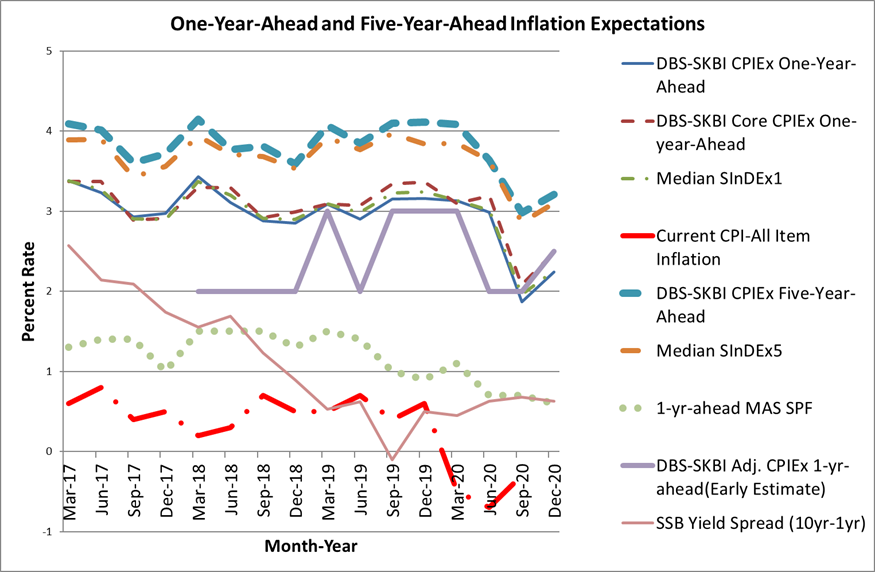

- One-year-Ahead headline inflation expectations rose to 2.2% in December 2020, from 1.9% in September 2020. This expectation for headline inflation is just above the lowest point polled in September 2020 since the inception of the SInDEx Survey in 2011, and is lower than the fourth quarter average of 3.2% from 2012 till 2019.

- As Singapore wound down Phase 3, some semblance of normalisation and global cues of recovery with the advent of vaccines might have buoyed inflation expectations. As a comparison benchmark, the MAS Survey of Professional Forecasters (MAS SPF) data released in December 2020 polled median CPI All-Item inflation expectations of -0.3% for 2020 and the MAS SPF median forecast for 2021 is 0.6%. The latest Department of Statistics’ CPI All-Items inflation reading in November 2020 was -0.2%.

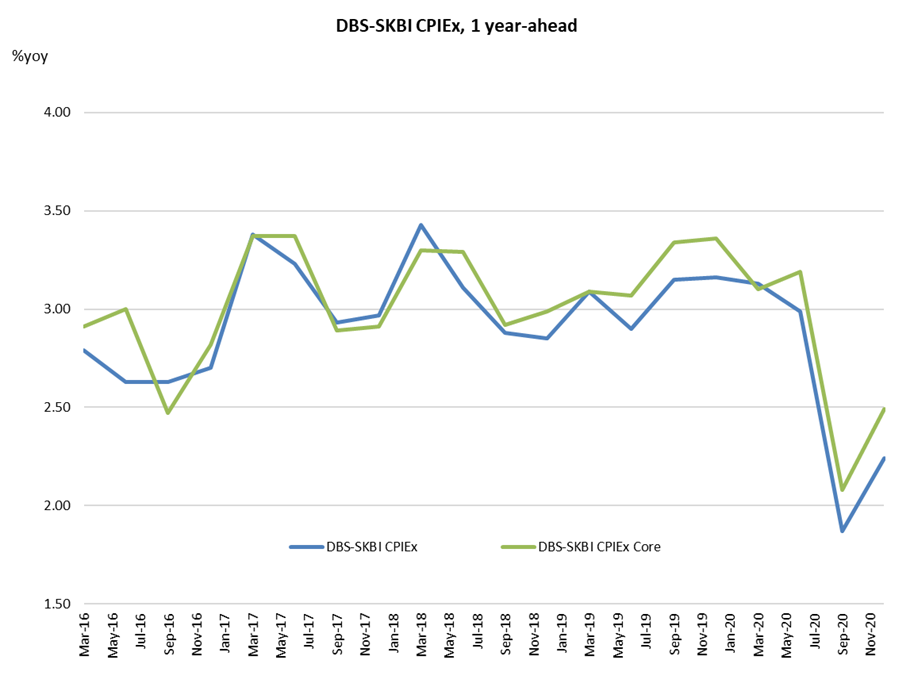

- The overall CPIEx Inflation Expectations, after adjusting for potential behavioural biases and re-combining across components, increased to 3.2% in December 2020 from 2.8% in September 2020. The trend in inflation expectations adjusted for behavioural biases seem to be in line with the general increase in inflation expectations, although inflation expectations for some components like healthcare, clothing & footwear, recreation & culture and communications have increased by a larger extent. We also observed that the free-response unadjusted overall inflation expectations increased to 2.5% in December 2020 compared to 2% recorded in the September 2020 survey, suggesting that the survey reduced the “anchoring bias” prevalent in many survey based instruments.

- In the December 2020 wave, similar to September 2020, an in-depth survey on the potential impact of Covid-19 on inflation expectations of different components of CPI was conducted. Unlike the September wave, we did not find any component inflation expectations significantly influenced as an aftermath of Covid-19.

- Following the academic work by Alberto Cavallo of Harvard Business School (2020) and the UK Office of National Statistics (ONS), respondents were asked if there were any substantive changes to their consumption basket. In September 2020, we observed moderate declines in households’ spending on clothing & footwear, transportation and recreation & culture. However, households’ consumption patterns appear to have reverted to pre-Covid norms in December 2020 as consumer spending picks up and economic activities resume.

- Excluding accommodation and private road transportation related costs, the One-year-Ahead CPIEx core inflation expectations edged up to 2.5% in December 2020 (from 2.1% in September 2020). This increase possibly reflects renewed economic activities, including a moderate increase in world commodity prices, as the world economy entered a recovery phase.

- For a subgroup of the population who owns their accommodation and uses public transport, the One-year-Ahead CPIEx core inflation expectations also increased to 2.1% in December 2020 from 1.9% in September 2020. Not being exposed to private road transportation or accommodation expenses, this subgroup’s expectations of core inflation closely resemble the Singapore Core Inflation Expectations.

- The One-year-Ahead composite index SInDEx1 that puts less weight on more volatile components like accommodation, private transport, food and energy, polled at 2.3% in December 2020 compared to 2% polled in September 2020. This remained below the fourth quarter average of 3.2% since the survey’s inception in 2012 till 2019.

- In December 2020, around 71% of the survey respondents reported their belief that Covid-19’s impact on inflation would be significant compared to 77% in September 2020. The share of survey respondents who feel that Covid-19 will have long-term impact on inflation also declined to around 72%, from nearly 79% in September 2020.

- In addition, around 18.1% of the Singaporeans polled expect a more than 5% reduction in salary in the next 12 months, this is a lower proportion compared to September 2020. The median salary increment expectations stayed between -1% and 1%.

- As a measure of the tradeoff between prioritizing economic growth compared to the cost to life, the so-called livelihood over life debate, the ratio was 3.1 in December 2020, nearly unchanged from 3.2 in September 2020. This means for every person who wanted to prioritize life over livelihood there are three who prioritized livelihood over life. This ratio was 2 in June 2020, which means for respondent who prioritized life over livelihood, two were prioritizing livelihood over life.

DBS Chief Economist and Managing Director of Group Research, Dr. Taimur Baig commented, “Inflation expectations in Singapore appear to be responding to global cues, with sentiments improving and yet not particularly strong. With the depth of the pandemic hopefully behind and supportive policies still in place, some pick up in food, energy, manufactured goods, and services prices can be expected. Accordingly, we see a welcome revival in inflation expectations, although they are by no means high.”.

Commenting on the results of the 38th round of the DBS-SKBI survey, SKBI Director Professor David Fernandez said, ”The sharp drop in inflation expectations, now followed by this stabilisation at low levels, is consistent with our view that policymakers won't want to withdraw Covid-induced support any time soon. It will be worth tracking, going forward, the pace at which inflation expectations recover.”

SMU Assistant Professor of Finance and founding Principal Investigator of the DBS-SKBI SInDEx Project, Aurobindo Ghosh observed, “The world exhaled a collective sigh of relief with the availability of the Covid-19 vaccine from Pfizer-BioNTech in November 2020, this was followed by other vaccines made available, leading to a belief that an end to the pandemic could be in sight. Prospects of global recovery have been renewed as a result of better global growth and trade prospects with the signing of the Brexit deal, change of regime in the US and the Regional Comprehensive Economic Partnership (RCEP) treaty. In addition, fewer respondents feel the impact of the pandemic will be longer term or have a significant impact. We also find less perceived distortion in consumption baskets and prices due to the pandemic, although there are expectations of higher inflation in some components like healthcare, clothing & footwear and communications.”

For the longer horizon, the Five-year-Ahead CPIEx inflation expectations in the December 2020 survey edged up to 3.2% from 3% in September 2020. The current polled number is significantly lower than the fourth quarter average of 4% since the survey’s inception in 2012 till 2019.

The Five-year-Ahead CPIEx core inflation expectations (excluding accommodation and private road transportation related costs) also increased to 3.1% in December 2020 compared to 2.9% in September 2020. Overall, the composite Five-year-Ahead SInDEx5 also increased to 3.1% in December 2020 from 2.9% in September 2020. In comparison, the fourth quarter average value of the composite Five-year-Ahead SInDEx5 was 3.8 % since the survey’s inception in 2012 till 2019.

“Moderate increase in long term inflation expectations bode well from three perspectives. First, the general uptick in Singaporeans’ inflation expectations was based on global cues that included strong commitment to the recovery by central banks which had signaled accommodative policies, both monetary and fiscal, for the immediate and foreseeable future. Second, long term inflation expectations seem more “anchored” in terms of global economic realities despite abundance of liquidity in the market. Finally, as a measure of the tradeoff between prioritizing economic growth compared to the cost to health, the ratio remained unchanged at 3 from September 2020 to December 2020. This means that for every 1 person who wanted to prioritize life over livelihood, there were 3 who prioritized livelihood over life, up from 2 in the June 2020 survey. These observations signal a higher public appetite of normalisation of economic activities that governments are paying heed to globally,” Professor Ghosh observed.