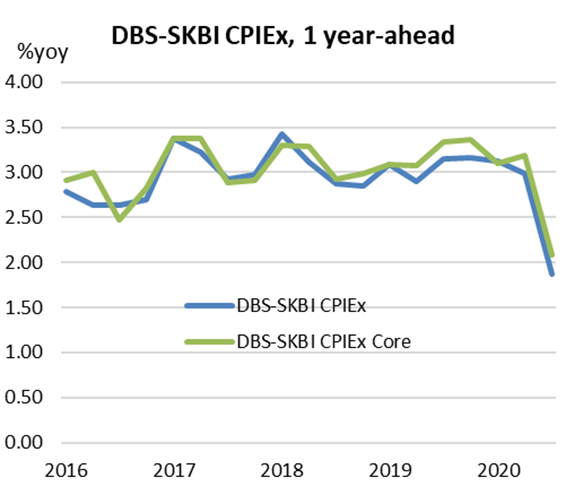

- One-year-Ahead headline inflation expectations significantly dropped to 1.9% in September 2020, from 3.0% in June 2020, much lower compared to the third quarter average of 3.3 % from 2012 till 2019. The inflation expectations for headline inflation is the lowest since the inception of the Singapore Index of Inflation Expectations Survey in 2011.

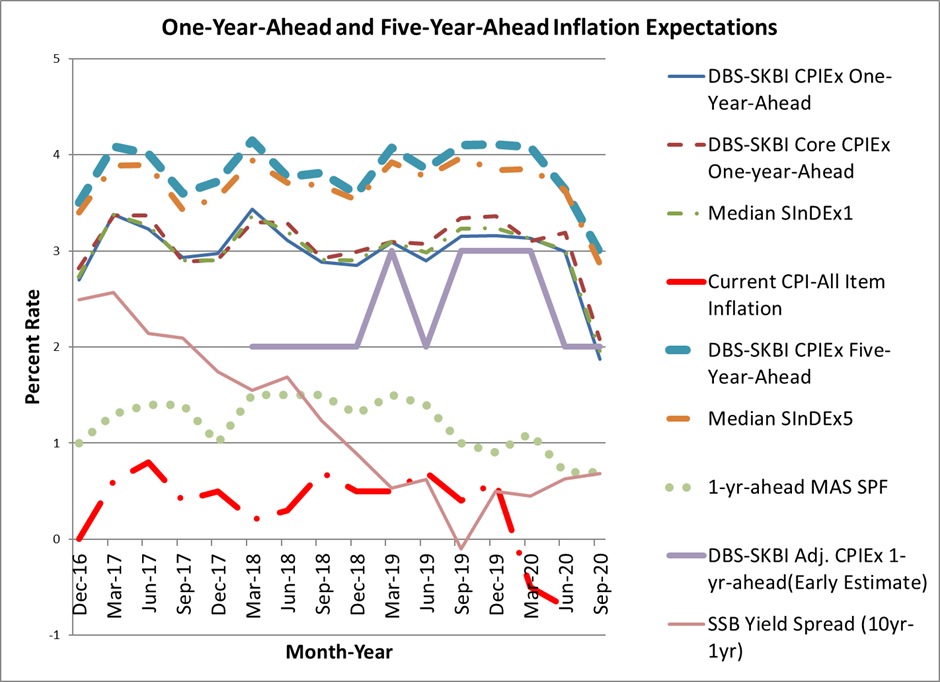

- The significant drop in inflation expectations across the board is emblematic of some degree of anchoring of inflation expectations in line with current published data. As a comparison benchmark, the second quarter CPI All-Items inflation released by MAS is -0.7% (dropping steeply from -0.5% in the first quarter) while the MAS Survey of Professional Forecasters (MAS SPF) data released in September 2020 polls CPI All-Item inflation expectations of -0.4% for 2020 and the MAS SPF median forecast for 2021 is 0.7%.

- The overall CPIEx Inflation Expectations, after adjusting for potential behavioural biases and re-combining across components, dropped to 2.8% in September 2020 compared to 2.9% in June 2020. The general drop in the behavioural bias adjusted inflation expectations seems to be more moderate. We also observed that the unadjusted overall inflation expectations of 1.9% is closer to the median of free response headline inflation expectations of 2%, this suggests that we have managed to reduce the behavioural bias known as “anchoring bias” that might have also contributed to the relative decline.

- In the September 2020 wave, an in-depth survey on the potential impact of Covid-19 on inflation expectations of different components of CPI was conducted. Overall, food and healthcare cost inflation expectations have limited positive impact possibly due to the expected disruption from the pandemic, while other components are not impacted.

- Analyzing the impact of Covid-19 on overall inflation expectations, and components like food, accommodation, transportation, healthcare, there is a divergence of views -- about half the respondents expect a positive impact while the other half expect a negative impact. Following the academic work by Alberto Cavallo of Harvard Business School (2020) and the UK Office of National Statistics (ONS), we further asked respondents to check if there were any substantive changes to their consumption basket. Due to the predominance of Work from Home (WFH) arrangements, there seemed to be an estimated moderate decline in budget share for Transportation cost. There was also a moderate decline in the budget share for Recreation and Culture cost owing mainly to restrictions of entertainment facilities. A moderate decline was observed in the budget share of Clothes and Footwear, both of which might be due to belt tightening of households.

- Excluding accommodation and private road transportation related costs, the One-year-Ahead CPIEx core inflation expectations corrected downwards to 2.1% in September 2020 (from 3.2% in June 2020). This drop is indicative of a possible realization of lower levels of growth prospect worldwide which is having a downward impact on inflation expectations in some developed nations.

- For a subgroup of the population who own their accommodation and use public transport, the One-year-Ahead CPIEx core inflation expectations pared to 1.9% in September 2020 from 3.1% in June 2020. Not being exposed to private road transportation or accommodation expenses, this subgroup’s expectations of core inflation closely resemble the Singapore Core Inflation Expectations.

- The One-year-Ahead composite index SInDEx1 that puts less weight on more volatile components like accommodation, private transport, food and energy, polled at 2% in September 2020, down from 3% in the June 2020 SInDEx survey, and below the third quarter average of 3.3% since the survey’s inception in 2012 till 2019.

- In September 2020, around 77% of the survey respondents believe Covid-19’s impact on inflation would be significant compared to 79% in June 2020. The share of survey respondents who feel that Covid-19 will have long-term impact on inflation remained stable at around 80%.

- In addition, around 24.3% of Singaporeans polled expect there will be a more than 5% reduction in salary in the next 12 months, while the median salary increment expectation is between -1% and 1%.

Figure 1: One-year-Ahead-inflation expectations: The chart show the quarterly DBS-SKBI CPIEx (CPI-All Item) and DBS-SKBI CPIEx Core (Excluding accommodation and private road transportation components) One-Year-Ahead Inflation Expectations polled in the quarterly online Singapore Index of Inflation Expectations (SInDex) Survey conducted September 11-18, 2020.

Source: SKBI, SMU

SMU Assistant Professor of Finance and founding Principal Investigator of the DBS-SKBI SInDEx Project, Aurobindo Ghosh observed, “There could be a few reasons for the drop in inflation expectations besides a general increase in risk and global economic uncertainty in projections highlighted by IMF World Economic Outlook in October 2020. First, it signals a broader decline in inflation expectations that also reflects the low levels of inflation expectations that are forecasted by professional forecasters. Second, we adjusted the options for the choices to be more in line with the observed numbers so as to avoid the behavioural bias called ‘anchoring’. Finally, we see some level of divergence of groups with different levels of inflation expectations possibly due to the change of basket composition, such as a reduction in transport, recreation and clothing and footwear categories. However, component-wise indices have generally stayed put or declined slightly from the previous wave in June 2020 and shows slightly higher estimates when aggregated. In particular, respondents feel that food and healthcare inflation will have moderately positive impact due to the global pandemic.”

DBS Chief Economist and Managing Director of Group Research, Dr. Taimur Baig commented, “A general decline in inflation expectations, a common thread in high income societies in the past decade, has become even more entrenched due to the Covid crisis and associated uncertainties. Singapore, in this regard is no exception, and the latest readings from the DBS-SKBI indices are particularly revealing about the sentiment of consumers. We do however believe that with a recovery shaping up, inflation expectations will recover somewhat in the coming quarters, as they have elsewhere in advanced economies.”

For the longer horizon, the Five-year-Ahead CPIEx inflation expectations in the September 2020 survey declined to 3% compared to 3.6% in June 2020. The current polled number is significantly lower than the third quarter average of 4% since the survey’s inception in 2012 till 2019.

The Five-year-Ahead CPIEx core inflation expectations (excluding accommodation and private road transportation related costs) dropped to 2.9% in September 2020 compared to 3.7% in June 2020. Overall, the composite Five-year-Ahead SInDEx5 dropped to 2.9% in September 2020 from 3.6% in June 2020. In comparison, the second quarter average value of the composite Five-year-Ahead SInDEx5 was 4 % since the survey’s inception in 2012 till 2019.

“Longer term inflation expectations also see some corrections across the board possibly due in part to the recalibrating of options in line with published data to reduce anchoring bias. In a survey of respondents on their views of the prioritization prospects of the life vs. livelihood debate as most governments including Singapore look to cautious reopening, we find some changes since our last survey. In June 2020, 80% of the respondents opined that at least some short-term economic costs could be borne to protect vulnerable population, this figure fell to about 78% in September 2020. As a measure of the tradeoff between prioritizing economic growth compared to the cost to health, the so-called livelihood over life debate, the ratio was 3.2 in September 2020 compared to 2.3 in June 2020. This means that for every 1 person who wanted to prioritize life over livelihood, there were 3 who prioritized livelihood over life, up from 2 in the June 2020 survey. These observations might signal a higher public appetite of normalization of economic activities that governments are paying heed to globally,” Professor Ghosh observed.

Figure 2: Five-year-Ahead-Inflation Expectations in Singapore: The chart shows the quarterly DBS-SKBI CPIEx (CPI-All Item), DBS-SKBI CPIEx Core (Excluding accommodation and private road transportation components), SInDEx (Composite index with lower weights on volatile components like food, energy, accommodation and private road transportation) One-Year and Five-Year-Ahead Inflation Expectations polled online quarterly for the Singapore Index of Inflation Expectations (SInDex) Survey conducted September 11-18, 2020. The chart shows a preliminary estimate of Behaviourally Adjusted One-year-Ahead overall DBS-SKBI Adjusted CPIEx. As comparison benchmarks, the chart provides the most recent quarterly CPI-All Item Inflation, MAS Survey of Professional Forecasters median One-year-Ahead CPI-All Item or headline inflation forecasts and the yield spread of 10-year and 1-year Singapore Savings Bonds (SSB).

Source: SKBI, SMU, MAS, Department of Statistics

|

Methodology DBS-SKBI SInDEx survey yields CPIEx Inflation Expectations (estimating headline inflation expectations) and related indices are products of the online survey of around 500 randomly selected individuals representing a cross section of Singaporean households. The survey is led by Principal Investigator Dr. Aurobindo Ghosh, Assistant Professor of Finance (Education) at Lee Kong Chian School of Business, SMU. The online survey collection powered by Agility Research and Strategy helps researchers understand the behavior and sentiments of decision makers in Singaporean households. DBS Group Research is a co-sponsor and research partner together with the Sim Kee Boon Institute for Financial Economics (SKBI) at SMU. The quarterly DBS-SKBI SInDEx survey has also yielded two composite indices, SInDEx1 and SInDEx5. SInDEx1 and SInDEx5 measure the 1-year inflation expectations and the 5-year inflation expectations, respectively. The sampling was done using a quota sample over gender, age and residency status to ensure representativeness of the sample. Employees in some sectors like journalism and marketing were excluded as that might have an effect on their responses to questions on consumption behavior and expectations. The DBS-SKBI SInDEx survey was augmented in June 2018, based on a joint research study conducted by SMU researchers in collaboration with MAS and the Behavioral Insights Team, where respondents were polled about their perceptions of components of the Consumers Price Index (CPI) and adjusted for possible behavioral biases prevalent in online surveys. Based on the recommendations of that study, the research team had, since March 2019 polled the One-year-Ahead inflation expectations of all of the major components of CPI-All Items inflation. Compared to June 2020, the September 2020 survey revealed inflation expectations have largely remained unchanged for overall and across most categories. The component-wise inflation expectations have largely stayed the same for Food, Housing and Utilities, Transportation, Education, Clothing and Footwear and Miscellaneous and dropped slightly in Healthcare, Clothing and Footwear, Household Durables, Communications and Recreation and Culture categories. Overall, in free response answers, compared to June 2020 survey, respondents in the September 2020 survey expected One-year Ahead and Five-year Ahead headline and core inflation expectations to drop. |